Why I Need Cash Offers the Best Car Loan Rates in 2025

- October 11, 2025

- Remy Anderson

- Finance

Summary

- I Need Cash offers the best car loan rates through a network of lenders, ensuring better terms than banks or dealerships.

- Credit scores matter, but the ability to handle repayments is more important for getting approved.

- I Need Cash uses soft credit checks to protect your score, allowing you to explore options without impact.

- Loan length significantly affects the total cost; fixed rates provide stability while variable rates introduce risk.

- Customers report saving up to 4% compared to dealership offers, with fast approvals and funding within minutes.

Table of contents

The Best Car Loans Rates

For the best car loan rates that actually work in your favour, this is where you need to look. Your car represents one of your biggest financial decisions in the UK – second only to your home for most people.

Credit scores matter, but not the way most lenders tell you. A 700+ score opens doors, though what really counts is whether you can handle the repayments.

You should expect to need an income of about £25,000 each year and a deposit of 10%. The standout difference? Some lenders give you answers in under 60 seconds.

I Need Cash is different from other car finance choices in 2025 for three key reasons: our network of lenders, our application process, and our interest rates. Our rates are often better than those offered by dealerships and banks for both new and used cars.

What makes a car loan rate the ‘best’ in 2025?

Image Source: Free Price Compare

Bear in mind, the lowest rate isn’t always the best rate. What counts is the total cost over your loan’s lifetime.

APR tells the real story

APR captures everything – interest plus fees. Current averages sit at 6.73% for new cars and 11.87% for used vehicles. Your credit score determines where you land:

| Credit Score, New Car Rate, Used Car Rate | ||

| 781-850 (Excellent) | 5.18% | 6.82% |

| 661-780 (Good) | 6.70% | 9.06% |

| 601-660 (Fair) | 9.83% | 13.74% |

| 501-600 (Subprime) | 13.22% | 18.99% |

| 300-500 (Deep subprime) | 15.81% | 21.58% |

Source: Experian State of Automotive Finance Market Q1 2025

Monthly payments can mislead you. Check the total cost of credit – a lower monthly payment often means thousands more in interest.

Fixed rates win for car loans

Most UK car loan finance agreements use fixed interest rates. Your rate stays locked throughout the loan term.

Variable rates start low but can go up if market conditions change. Fixed rates give you certainty. Variable rates give you risk.

Loan length changes everything

The length of your term affects your finances more than small changes in rates. Take a £10,000 loan at 6.84% interest:

- 48-month term: £712.83 monthly, £4,355.44 total interest

- 84-month term: £448.34 monthly, £7,800.30 total interest

The longer term saves £265 monthly but costs £3,444.86 extra overall. Most borrowers focus on what you can afford and ignore the bigger financial picture.

How I Need Cash evaluates your car loan application

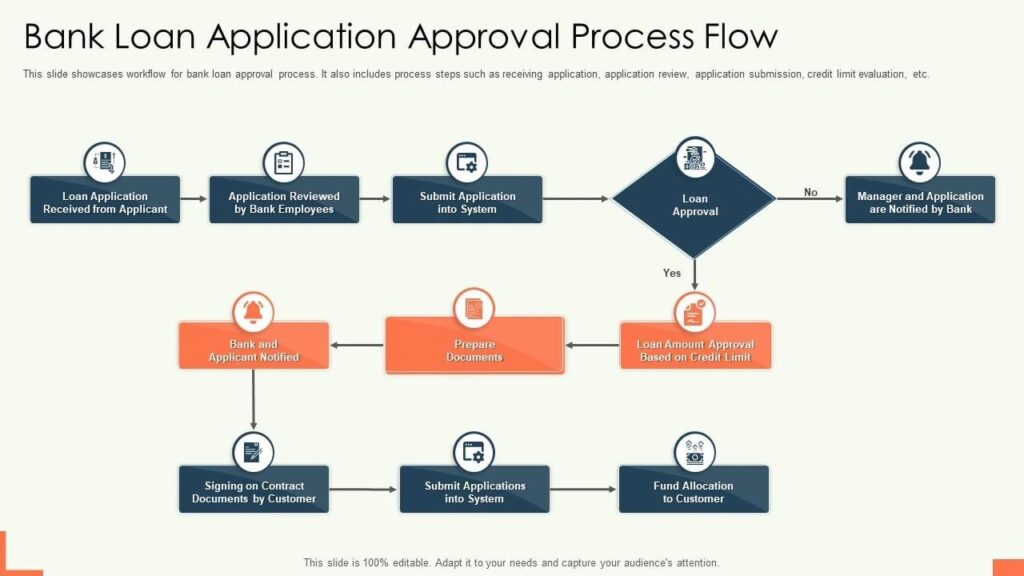

Image Source: Slide Team

Our application process is not the same as traditional lenders. You get matched with the right lenders through a system that selects both your ability to repay while being realistic.

Soft vs hard credit checks explained

We start with a soft credit check that won’t damage your score. Unlike hard searches that show up on your credit file, soft checks stay invisible to other lenders.

You can explore quotes without any credit impact. Only when you accept a specific offer does a hard credit search happen. This protects your credit rating while you shop around.

How affordability is assessed

What you can afford to repay matters more than perfect credit here. We look at your disposable income, which is what you have left after paying for necessary expenses.

Having a good amount of money to spend can help you get better rates, even if your credit is not perfect. Some lenders use Open Banking to check your information. Other lenders ask for bank statements to check your finances.

What documents are required

You’ll need these essentials:

- Personal and employment details

- Three-year address history

- Photo ID (driving license or passport)

- Income proof (payslips or bank statements)

- Address proof (utility bills within 60-90 days)

These documents verify identity and finances while preventing fraud.

Vehicle restrictions

Vehicle restrictions apply. Lenders consider make/model, age, and mileage of your chosen car. Commercial vehicles, motorcycles, caravans, and motorhomes don’t qualify. Enter your vehicle details during application to check instantly if you are eligible.

This streamlined process connects you with lenders offering the best car loan rates for your specific situation.

Why I Need Cash beats every other car loan option

This is the only car loan service we’d recommend in 2025.

Multiple lenders compete for your business

Banks offer you only one rate, but I Need Cash lets many lenders compete for your application. This extensive network means better best car loan rates and higher approval chances. It’s like having all the top lenders compete for you. We do the hard work, and you get better terms and the lowest rates.

Your profile gets matched to the right lender for best car loan rates

Complete our form once, and we target lenders offering the best used car loan rates for your exact situation. This is not a one-size-fits-all method. It matches things precisely, similar to the best comparison websites. It does all the searching for you while you wait.

Bad credit? They’ve got specialist lenders

Poor credit history doesn’t mean poor rates here. Our panel includes lenders who specialise in bad credit situations. Many of our partners look at your disposable income and credit scores. They could approve applications that are turned down by others.

Zero fees, complete transparency

Here’s what sets us apart: I Need Cash charges absolutely nothing for our service. Every lender we work with follows the rules set by the Financial Conduct Authority. This means you have full protection as a consumer.

If you want the best car loan rates without the run around, this is where you go.

Real customer results prove the point

Our results don’t lie; when it comes to car finance, I Need Cash delivers exactly what customers need.

Used car loans: The savings are real

Customers report rates up to 4% lower than dealership offers on used vehicles. Our streamlined process consistently beats traditional bank financing for comparable cars.

What customers actually say

July 2025 feedback speaks for itself: “Fantastic service and swift payment”. Another borrower: “Received a loan of £200 when nobody else would. Really easy application and money was sent within 10 minutes of approval”.

The pattern continues: “Hassle free short time loan. Wouldn’t hesitate to use this company again”.

Speed that matters with best car loan rates

Here’s what sets them us from other lenders:

- Decisions within seconds

- Approval faster than traditional banks

- Funds in accounts within 1-3 business days

Many customers get their money in 10 minutes after approval.

It takes about 10 to 15 minutes to fill out the application. After that, the process continues right away. This speed gives you the edge when negotiating with lenders.

These are the rates you need for your next car purchase

The best car loan rates UK can save you thousands over the repayment term. i Need Cash helps you find lenders. We offer better rates than banks and dealerships. Additionally, you can get quick approval.

Our soft credit check approach protects your credit score while you explore options. If you have bad credit, our special group of lenders often approves applications that others turn down. Zero fees mean every pound goes toward your loan, not service charges.

Our customers show great results. We offer rates that are up to 4% lower than regular lenders. You can get approved in seconds and receive funds in minutes. Real people getting real savings on both new and used car purchases.

If you need car finance in 2025, this is where you start. Check what we can offer before you commit anywhere else.

Estimated reading time: 7 minutes

Related links