How to Find Cheap Personal Car Loans

- July 16, 2025

- Remy Anderson

- Car Finance

Summary

- Personal car loans offer flexibility and full ownership, making them a cost-effective option for buying cars.

- Borrowing amounts and loan terms impact interest costs significantly; research is essential for finding cheap personal car loans.

- Using loan comparison tools and understanding APR helps in identifying the best loan rates available.

- Your credit score plays a crucial role in securing low rates; improving it can lead to substantial savings.

- Consider alternatives like PCP, HP, or leasing based on your vehicle ownership plans and needs.

Table of contents

Cheap Car Loans

Personal loans remain one of the cheapest ways to get car finance, even though their rates have almost doubled in the last two years. How to find cheap personal car loans can change constantly.

Knowing your car loan choices can help you save a lot on interest.

To cite an instance, borrowing £10,000 at 7% over three years would cost you £1,100 in interest. The same loan stretched to 10 years would lead to a massive £3,900 interest bill!

Personal loans give you flexibility and higher borrowing limits than credit cards, but they’re not always your best choice. A money transfer credit card might work better for amounts under £3,000 if you can clear the balance within 12 months.

Loan rates have started to decrease, which is good news, though they still sit much higher than a few years ago.

This guide will help you compare the best car loans in the UK.

You will learn what you need to qualify and find other ways to save money when buying your next car.

Understanding Personal Car Loans

Personal car loans give you complete control over your vehicle purchase right from the start. These loans work separately from your car purchase location, unlike other financing options.

What is a personal car loan?

A personal car loan works as an unsecured loan you take out to buy a vehicle. The bank transfers money straight to your account so you can pay for the car in full. You become the car’s owner immediately instead of the finance company.

You can typically repay these loans between one and seven years. The bank sets your monthly payments based on your credit score, and you pay the same amount each month.

Personal car loans let you buy from anywhere – dealerships, private sellers, or auctions. Since you own the car outright, you can modify or sell it whenever you want.

How do car loans differ from other finance options?

The biggest difference between personal car loans and other options comes down to ownership and rules. You don’t own the vehicle while making payments with PCP or HP finance. A personal loan makes you the owner right away.

Personal loans also give you:

- No mileage limits that you often find with PCP deals

- Freedom to modify your vehicle

- The ability to sell your car before paying it off

- Loan terms up to seven years, compared to five years for many HP deals

Car finance deals usually restrict you to approved dealers, but personal loans let you shop anywhere.

When is a personal loan the right choice?

People with good credit scores benefit most from the best car loans UK. They can access better interest rates, which might make loans cheaper than car finance options.

A personal loan makes sense if you:

- Want to own your car without restrictions

- See yourself keeping the car for years

- Need flexibility in where you buy

- Have good credit that qualifies you for competitive rates

- Want to mix the loan with other money to buy your car

Even so, cheap car finance no deposit UK deals can be better for people with bad credit. The car acts as security for the loan.

How to Compare and Find Cheap Car Loans

Getting the best car loan rates needs smart comparison shopping. Lenders have different rates, so it’s good to spend time researching.

Using loan comparison tools effectively

Online comparison tools help you search offers from lenders of all types. These tools let you scan the market quickly to find deals that match your situation. The headline rates don’t tell the whole story – try adjusting loan amounts and terms to find better options.

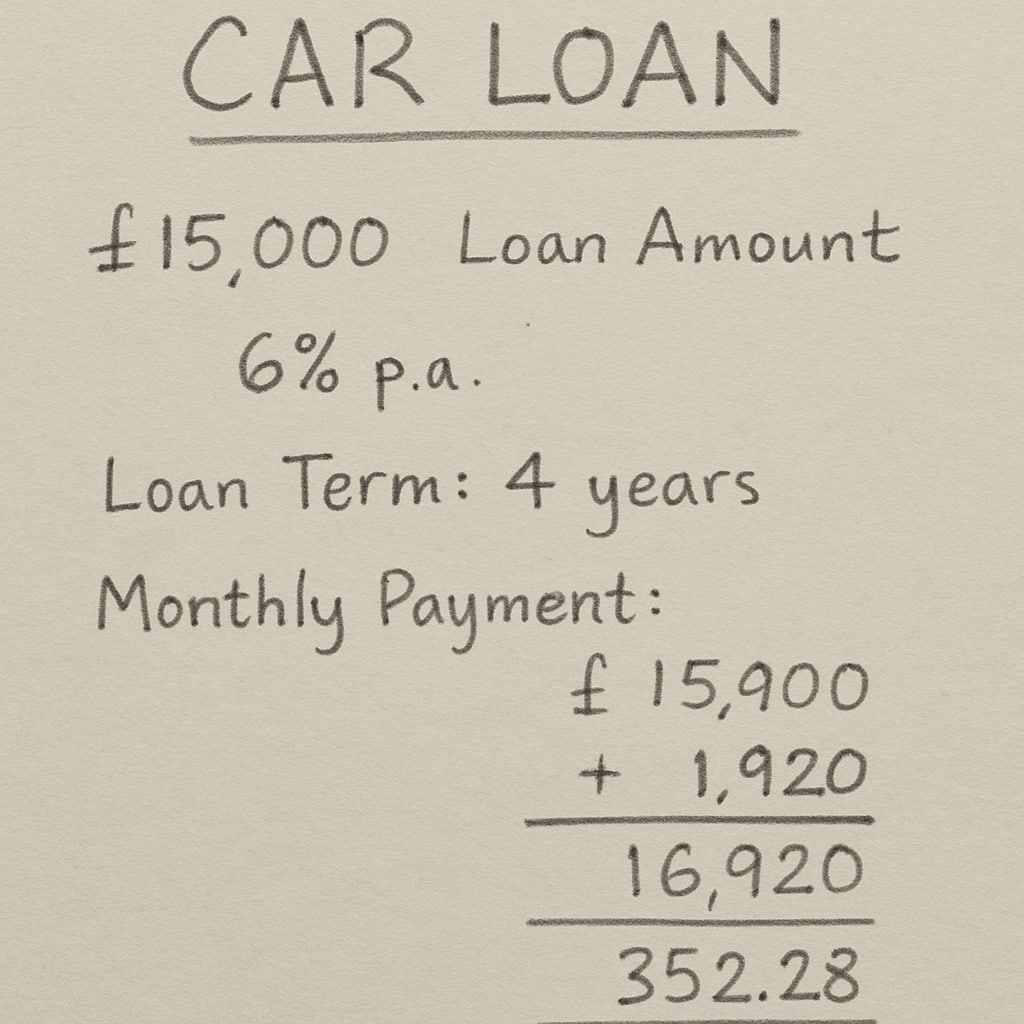

Loan calculators are a great way to get a clear picture of monthly payments for different scenarios. You’ll see exactly how changing loan terms affects your budget. Keep in mind that shorter terms usually mean lower interest rates but higher monthly payments.

Understanding representative APR and real rates

The Annual Percentage Rate (APR) combines interest rates and fees into a single number. You can use this number to compare different options.

Most advertised rates are “representative APRs.” This means at least 51% of people who are approved will get this rate or a better one. However, up to 49% may pay more.

Your credit score, deposit amount, and loan term largely determine your personal APR. Look for lenders who show “personal” or “exact” APRs through soft credit checks – these won’t hurt your credit score.

Why borrowing slightly more can sometimes be cheaper

Here’s something surprising – borrowing a bit more might save you money. Studies show that borrowing just £50 extra could save up to £1,600 throughout the loan term. This happens at specific amounts – usually between £4,500 and £8,000 – where interest rates drop by a lot.

One major bank’s numbers show that a £5,000 loan over four years costs about £1,300 less than borrowing £4,950 for the same period.

How to spot hidden fees and charges

Watch out for these costs beyond the APR:

- Early repayment charges if you want to clear your loan early

- Admin fees hidden in small print

- Extra insurance that makes monthly payments bigger

- Balloon payments that leave you with a huge final bill

Read your agreement carefully, especially parts about fees, penalties, or commissions. Super-attractive deals often hide poor terms.

Eligibility and Application Process

Your credit score plays the biggest role in getting cheap personal loans and deciding your interest rate. The right credit score could help you save thousands throughout your loan term.

How your credit score affects car loan rates

Interest rates change drastically based on your credit scores. New car buyers with excellent credit scores (781+) get average rates of 5.18%. People with poor credit end up paying around 15.81%. Used car rates show an even bigger difference – 6.82% for excellent credit compared to a whopping 21.58% for poor credit.

Lenders look beyond your score. They inspect your payment history and check your debt-to-income ratio (DTI). Most prefer to work with borrowers who have a DTI under 50%.

What documents you need to apply

Lenders usually ask for:

- Proof of identity (driving license or passport)

- Proof of address (utility bills or bank statements from the last 90 days)

- Proof of income (recent payslips or bank statements)

- Bank account details for payment setup

- Address history for the past three years

Self-employed people need to show additional trading accounts to prove their income.

How to improve your chances of approval

Here’s what you can do to boost your approval chances:

Start by checking your credit reports from Experian, Equifax, and TransUnion for any mistakes.

Please pay your bills on time. Try to reduce your current debt to improve your credit use.

Getting on the electoral roll can give your score a quick boost.

A bigger deposit lowers the lender’s risk if your application is close to being approved.

Finding a co-signer with a credit score over 670 can really help if you need a backup option.

What to do if your application is rejected

Lenders must send you an adverse action notice explaining why within 60 days. Don’t rush to apply elsewhere – multiple hard searches will hurt your score more. Focus on fixing the root causes first.

If you have bad credit, create a solid plan to pay off existing debts. You might want to check out specialist lenders who work with people who don’t have perfect credit histories.

Alternatives and Cost-Saving Tips

Car buyers have several financing options beyond personal car loans.

Knowing these options can save you a lot of money over the life of your vehicle.

When to think over PCP, HP, or leasing

Your needs decide the best way to get financing.

Personal Contract Purchase (PCP) suits people who like to switch to newer vehicles often. It offers lower monthly payments but needs a final “balloon payment” to own the car outright.

Hire Purchase (HP) works better for those who plan to keep their vehicle long-term. HP has slightly higher monthly payments but gives you full ownership without any balloon payment.

Leasing (PCH) becomes a great choice if you don’t want to own the vehicle and prefer fixed monthly costs. Studies show leasing can be 30% cheaper than PCP for the same car over similar terms. It also has better rates for cars that keep their value well.

Using 0% credit cards for car purchases

A 0% purchase credit card proves economical for smaller amounts, usually under £3,000. This option is good if you want to pay off the balance before the interest-free period ends.

You’ll need an excellent credit score and enough credit limit to cover the purchase price.

Paying off your loan early: pros and cons

Paying off your loan early can help you save a lot on interest. This is especially true for simple interest loans. They calculate interest every month based on how much you still owe.

It also gets rid of monthly payments. It improves your debt-to-income ratio and stops problems with negative equity.

Some lenders may charge fees if you pay off your loan early. These fees can be higher than the money you save on interest. Making big payments can also use up your emergency savings and make you less secure financially.

Other costs to factor in: insurance, tax, maintenance

The purchase price starts your car ownership experience. Insurance costs average about £561 yearly, with rates that change based on vehicle type and driver profile. Road tax (VED) rates depend on emissions, and low-emission vehicles pay less.

Yearly maintenance typically costs between £300-£500 for routine servicing. Surprise repairs can cost a lot more.

Ongoing costs should influence your car choice as much as the buying price.

Conclusion

The right cheap car finance UK demands research and a good look at your financial situation. This piece explores how personal cheap loans give you flexibility and immediate ownership that other options can’t match.

Personal loans are still a cost-effective way to buy a car, despite recent interest rate hikes. You can save thousands in interest payments over the loan term by comparing offers from multiple lenders.

Your credit score is a vital factor that determines the rates you’ll get. Look at your credit reports. Work on raising your score before you apply. This can help you get approved with better terms.

On top of that, it helps to know how loan thresholds work – they might save you money. To name just one example, borrowing just £50 more could reduce your interest payments if it puts you in a lower rate bracket.

Your needs might be better served by PCP, HP, or leasing, depending on how long you’ll keep the vehicle. Like in shorter-term purchases, 0% credit cards work well when you can clear the balance quickly.

The total cost of ownership goes beyond the purchase price. Insurance, taxes, and maintenance costs will affect your budget while you have the vehicle.

The best car loans give you full control from day one – you own the vehicle outright, drive unlimited miles, and sell whenever you want.

This freedom, along with low rates for people with good credit, makes personal loans a good option to consider for buying your next car.

Estimated reading time: 10 minutes

Related links