How to Find Best Car Finance Options in the UK: A Money-Saving Guide

- September 15, 2025

- Remy Anderson

- Car Finance

Key Takeaways

- Eighty-one percent of new cars in the UK were purchased through finance, mainly via PCP deals, highlighting the importance of finding the best car finance options.

- Understand your budget and vehicle needs before choosing a finance deal to avoid future financial strain.

- Compare various financing methods: PCP offers lower monthly costs with optional ownership, while HP allows for full ownership after higher payments.

- Use comparison tools to find the best car finance options with low APRs and check for hidden fees or balloon payments.

- Avoid common mistakes like focusing solely on monthly payments and overlook the total cost, including interest and potential penalties.

Table of contents

Best Car Finance Options

You might be surprised to learn that 81% of new cars registered to private buyers in the UK were purchased using finance in the 12 months up to August 2024. Getting the best car finance options available.

The numbers tell an even more interesting story – 83% of these financed vehicles were paid for through PCP deals. New cars, like the Dacia Sandero for £14,200 and the Kia Picanto for £15,845, highlight why it’s important to find good car finance options. This can save you money.

Car buyers have several paths to get behind the wheel, from cheap car loans to personal car loans.

Personal loans can be a cheap way to buy a car. However, if a dealer offers 0% financing, that might be a better option. The main financing choices boil down to three options: Hire Purchase (HP), Personal Contract Purchase (PCP), and car leasing.

This piece will guide you through everything you need to know about finding the UK’s best car loan finance options. You’ll learn how to make a smart financial decision that fits your needs and budget perfectly.

Start with Your Budget and Needs

You need a clear picture of your financial situation and vehicle needs before picking a car finance deal. Smart choices now can save you thousands of pounds down the road.

Decide how much you can afford monthly

First, find out how much you earn after taxes.

Experts say you should list all your expenses, like rent, bills, food, and daily costs. Then, subtract that total from your monthly income. This shows exactly how much you can put toward car payments.

Note that owning a car comes with extra costs beyond financing:

- Insurance

- Car tax (VED)

- Repair and maintenance

- Fuel

Your monthly payments will be lower if you stretch out your finance term. But a longer term means you’ll pay more interest overall. It also helps that putting down a bigger deposit will cut your monthly payments by a lot.

Think about how long you’ll keep the car

Different car arrangements work for different timeframes. Short-term leases run from a few months to a year and give you flexibility when your needs shift. Long-term agreements that last two to five years often have lower monthly payments.

Your job stability is important. When you have a stable job, you can look for better long-term car options that fit your budget. But shorter commitments might work better if your situation could change or you like driving new models often, even though they cost more.

Do you want to own the car or return it?

This basic question helps you pick the best car finance option.

With a Personal Contract Purchase (PCP), you have three options at the end. You can buy the car with a final payment, return it, or trade it for a different car.

Hire Purchase (HP) spreads the total cost across fixed monthly payments, and you’ll own the car after the final payment. This works great if you want to own your car without worrying about mileage limits.

Personal Contract Hire (PCH) works like a long-term rental with no option to own at the end. Many drivers who like switching cars regularly without ownership responsibilities find this appealing.

Your choice really comes down to your money situation, how often you want a new car, and whether owning matters to you.

Image Source: Financial Mentor

Explore the best car finance options

The car finance world offers four main ways to fund your next vehicle purchase. A small emergency cash loan in most circumstances would not be suitable.

PCP: Low monthly cost, optional ownership

A Personal Contract Purchase starts with a deposit. You then make regular monthly payments for a certain time.

You only pay for how much the car will lose in value, not its entire price. Your monthly payments depend on things like how much money you put down and the interest rate you agree on.

The finance company owns the vehicle for the whole contract. You need to set a mileage allowance upfront – extra miles will cost you more. The agreement ends with three choices:

- Return the car with nothing more to pay

- Pay a final “balloon payment” to buy the car outright

- Trade it in for another vehicle on a new PCP deal

HP: Higher payments, full ownership

Hire Purchase works like PCP but has one big difference – you pay off the car’s full value during the contract. The monthly payments are usually higher than PCP or leasing. You’ll need a larger deposit at the start.

The best part is that you become the car’s owner after making all payments plus a small fee (usually £100-£500). You don’t need to worry about mileage limits or the car’s condition.

PCH: Lease with no ownership

Personal Contract Hire, or leasing, works as a long-term rental. The car never becomes yours – you give it back once the contract ends. Monthly costs stay lower than PCP because you’re not paying toward ownership.

Many leasing companies handle road tax payments, but you take care of maintenance. Just like PCP, stick to agreed mileage limits and avoid too much damage to dodge extra charges.

Personal car loans: Own from day one

Getting a personal loan means the car belongs to you right away, unlike dealer finance options.

You can drive as much as you want and make any changes to your vehicle. Dealer incentives won’t apply, but you avoid any restrictions on using the vehicle. Your monthly payments clear the debt by the end of the term, which usually runs from one to five years.

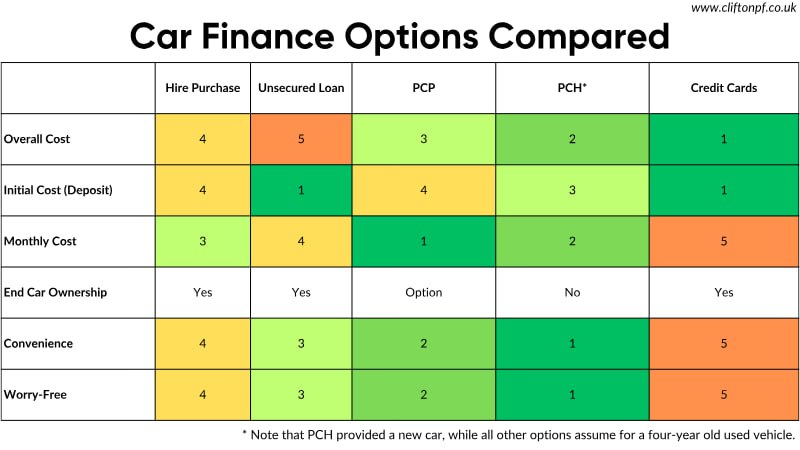

Image Source: Clifton Private Finance

How to Find the best car finance options: Loans for Cars or Finance Deals

Getting the best car finance deal takes more than picking the first offer you see. You can save a lot of money throughout your finance agreement with the right research tools and know-how.

Use comparison tools and eligibility checkers

Comparison websites help you check if you qualify for different finance deals without hurting your credit score. These “soft searches” show the loans you’re likely to get approved for. Services like Experian let you see pre-approved offers, which gives you peace of mind when you apply. You can complete most checks in under two minutes, and they stay valid for about 30 days.

Look for best car finance options with low APR

Your total repayment amount depends heavily on the Annual Percentage Rate (APR). Right now, many lenders have rates starting from 5.9% APR representative for loans between £7,500 and £25,000. Note that lenders show representative rates – only 51% of approved applicants get the advertised rate. A better credit score boosts your chances of getting lower interest rates.

Check for hidden fees and balloon payments

Make sure you calculate the total cost with all interest included. PCP agreements need extra attention because of the final balloon payment you’ll need to make if you want to keep the car. Watch out for mileage penalties in contracts too – they can bump up your costs by a lot if you go over the limit.

Ask about deposit contributions and extras

Car makers and dealers often throw in deposit contributions – extra money they add to your deposit for finance purchases. These contributions work like discounts and help lower your total cost. A £2,000 deposit contribution on a £28,000 car means you’ll pay £26,000 plus finance charges. These deals usually don’t last long and are linked to specific finance products.

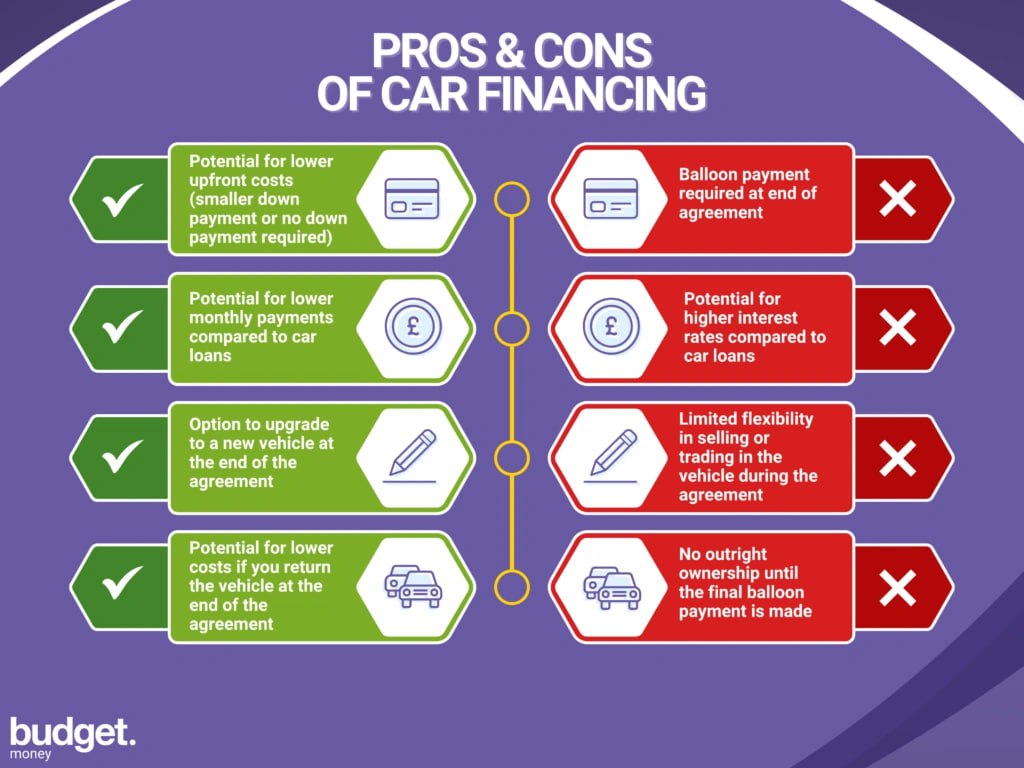

Image Source: Budget Insurance

Avoid Common Mistakes and Save More

Smart shoppers know they need to avoid common pitfalls to get the best car finance options. Let’s look at four critical mistakes you should avoid during car finance arrangements.

Don’t focus only on monthly payments

Monthly payments might look tempting when they’re low. This matters because it often means more expenses. This is especially true for PCP deals that have large balloon payments at the end.

Many people take the first loan offer they get without checking other options. This leads to bad terms and higher interest rates. The total amount you need to pay back is more important than what you pay each month.

Watch out for mileage limits and penalties

PCP and PCH agreements come with excess mileage charges when you go over your limit. You’ll pay anywhere from 3p to 30p per mile. Most finance companies charge about 14.9p per mile.

The maths is simple – going over by 5,000 miles costs £745 plus VAT. The best way to dodge these charges is to work out your yearly mileage. Add a couple thousand extra miles as a safety net.

Avoid long-term deals that cost more overall

Your monthly payments drop when you stretch out your finance term. However, this costs you a lot more in total interest paid. Lower payments might feel easier on your wallet now, but you end up paying more interest as time goes by.

Take a good look at your budget before you commit. Make sure you can handle the payments without money worries.

Know your credit score and improve it if needed to get the best car finance options

Your credit report shows which deals you can get, so check it before applying. Do you have a less-than-ideal credit score? Get on the electoral roll, pay your bills when they’re due, cut down credit card debt, and don’t apply for multiple credit lines at once. Better credit scores are a great way to get lower interest rates and better loan terms.

Conclusion – best car finance options

Getting the best car finance deal can be straightforward. The right choice could save you thousands of pounds during your agreement.

You may like PCP for lower monthly payments. You might prefer HP for a way to own the car. Leasing is simple, and a personal loan offers flexibility. Choose what fits your budget and lifestyle best.

Looking beyond monthly payments will help you avoid paying more in the long run. Calculate the total cost by including interest, fees, and any balloon payments. Set realistic mileage limits to dodge expensive penalties with PCP and PCH agreements.

Your credit score can make a huge difference in getting better terms. It makes sense to check and boost your score before you apply.

Using comparison tools and eligibility checkers can help you find deals that work for you. They won’t harm your credit rating.

Take enough time to read all terms carefully before signing anything. The best car finance options should give you both your dream vehicle and financial freedom. Smart planning and your newfound knowledge will help you drive away knowing you’ve made the right choice for your future on the road.

If you are looking for a car loan, see how we can help.

Estimated reading time: 10 minutes

Related links